SunPower Corp. today announced financial results for its fourth quarter ended December 30, 2018.

Fourth Quarter Highlights

- Solid financial performance: strong cash generation quarter

- Significantly delevered balance sheet: more than 50 percent sequential net debt reduction

- Completed previously announced business re-segmentation

SunPower Energy Services (SPES)

● North American residential annual deployments increased 15 percent

● Record commercial bookings quarter: 80 percent of 2019 forecast in backlog

SunPower Technologies (SPT)

● Initial production of company's Next Generation Technology (NGT) panels

● Expanding NGT capacity: initiated process for second manufacturing line

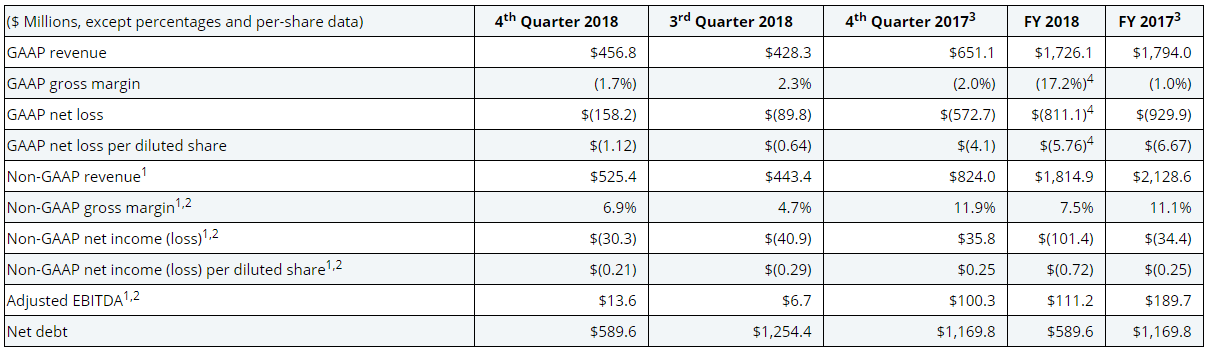

1.Information about SunPower's use of non-GAAP financial information, including a reconciliation to U.S. GAAP, is provided under "Use of Non-GAAP Financial Measures" below.

2.Excludes polysilicon costs related to its above market polysilicon contracts

3.The company adopted the new revenue recognition standard effective January 1, 2018. The prior periods presented here have been restated to reflect adoption of the new standard.

4.Includes impairment charges of approximately $369.2 million for legacy manufacturing assets of which $355.1 million is recorded in GAAP gross margin in second quarter 2018.

"I'm pleased we were able to post solid financial performance for the quarter while achieving a number of strategic milestones including re-segmenting our business structure to improve transparency and accountability, the initial production of our NGT cell and panel technology, as well as further delevering our balance sheet through the successful deconsolidation of our residential lease portfolio," said Tom Werner, SunPower CEO and chairman of the board.

SunPower Energy Services (SPES) – North American Residential and Commercial Businesses

"We executed well in our North American distributed generation (DG) business as demand remained strong in the fourth quarter. In particular, our U.S. residential business saw annual deployment growth of more than 15 percent. We saw increased demand for our complete residential Equinox solution , further traction for our loan product, and expanded our leadership position in the new homes channel with partnerships with 17 of the top 20 U.S. new home builders. Finally, we continue to see strong interest in our residential storage and services offerings and remain on plan to launch our Equinox residential storage solution this year.

"In Commercial, we remain the market share leader. For the quarter, we posted record bookings from both new and repeat customers including Cabot and Walmart. With the addition of these orders, we now have material revenue and volume visibility for the second half of 2019 with more than 80 percent of our 2019 commercial forecast already in backlog.

"We also continue to see significant interest in our Helix solar-plus-storage solution with attach rates of 35 percent. With the continuing success of the rollout of our Helix storage solution, we see significant opportunity in bringing this industry leading technology to our commercial installed base of more than 1.3 gigawatts (GW).

SunPower Technologies (SPT) – Manufacturing, International DG / Power Plant panel businesses

"First, we were pleased to appoint Jeff Waters as our new SPT business unit CEO during the quarter. Jeff brings a wealth of technology, operational and international business expertise to our team and we look forward to working together as he leads our manufacturing, research and development (R&D) and international downstream activities.

"We made significant progress on NGT as we started initial customer shipments for this industry leading technology in the fourth quarter of 2018. Additionally, we have already started the process to ramp our second manufacturing line which will more than double our NGT name plate capacity to approximately 250 MW by the end of 2019. Also, we recently began production of our P-Series technology at our manufacturing facility in Oregon and expect to ship up to 150 MW of P-Series from this facility this year, expanding our DG product offering in the U.S.

"SPT demand also remained solid in the quarter as we saw continued strength in our EMEA DG business and increased bookings in our international power plant supply agreement business. With these orders, we now have more than 750 MW of our 2019 international business in backlog.

Business Segmentation

"Finally, we materially completed our corporate transformation efforts during the quarter. As we have mentioned, over the last year, we have successfully simplified our business model, delevered our balance sheet and reduced operating expenses. We focused our investments in those areas that we believe offer the best opportunities for growth including our industry leading NGT cell and panel technology, solar-plus-storage solutions for our DG business, our digital platform to improve customer service and satisfaction, as well our energy services offerings," Werner concluded.

"Strong execution enabled us to achieve our strategic initiatives for the quarter," said Manavendra Sial, SunPower chief financial officer. "With the sale and deconsolidation of our residential lease portfolio during the quarter, we have simplified our financial statements and reduced our net debt by more than 50 percent to less than $600 million by the end of the year. Additionally, we improved our cash position and prudently managed our operating expenses while further investing in our growth initiatives. With the completion of our strategic transformation, DG-focused strategy and commitment to technological innovation, we are well positioned for sustainable profitability in 2019."

Fourth quarter fiscal year 2018 non-GAAP results exclude net adjustments that, in the aggregate, improved non-GAAP earnings by $127.9 million, including $81.3 million related to impairment and sale of residential lease assets, $37.2 million related to cost of above-market polysilicon, $11.0 million related to sale-leaseback transactions, $6.4 million related to stock-based compensation expense, $1.9 million related to intangibles, $1.3 million related to business reorganization costs and, partially offset by $6.6 million related to tax effect, $3.1 million acquisition-related and other costs, $1.1 million related to restructuring expense, and $0.5 million related to utility and power plant projects.

Financial Outlook

The company expects financial performance to improve on a quarterly basis throughout fiscal year 2019 with performance weighted towards the second half of the year given its record commercial bookings in the fourth quarter of 2018 as well as normal seasonality in its residential business. The company also expects fiscal year 2019 adjusted EBITDA to increase approximately 60 percent on a normalized basis adjusting for non-controlling interest due to the sale of its residential lease portfolio, as well as the impact of Section 201 tariffs paid during the year, both of which will not occur in 2019. The company believes that the change in its leasing business structure will improve lease economics starting in 2019. The company will provide additional details on its 2019 financial guidance at its Capital Markets Day on March 27, 2019.

Specifically, the company's first quarter fiscal year 2019 GAAP and non-GAAP guidance is as follows: On a GAAP basis, revenue of $290 million to $330 million, gross margin of (3) percent to 0 percent and a net loss of $70 million to $50 million. On a non-GAAP basis, the company expects revenue of $350 million to $390 million, gross margin of 3 percent to 5 percent, Adjusted EBITDA of $(40) million to $(20) million and MW deployed in the range of 360 MW to 400 MW.

The company's fiscal year 2019 GAAP and non-GAAP guidance is as follows: revenue of $1.8 billion to $1.9 billion on a GAAP basis and $1.9 billion to $2.0 billion on a non-GAAP basis, GW deployed in the range of 1.9 GW to 2.1 GW, non-GAAP operational expenses of less than $280 million, capital expenditures of approximately $75 million and Adjusted EBITDA of $80 million to $110 million.