August 20, 2014 - JA Solar Holdings Co., Ltd. today announced its unaudited financial results for its second quarter ended June 30, 2014.

Second Quarter 2014 Highlights

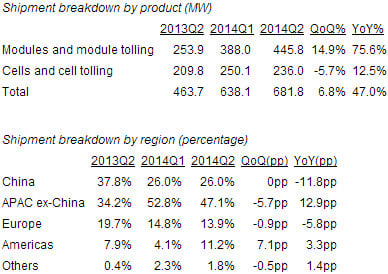

- Total shipments were 681.8MW, increases of +47.0% y/y and +6.8% sequentially

- Shipments of modules and module tolling were 445.8MW, increases of +75.6% y/y and +14.9% sequentially

- Shipments of cells and cell tolling were 236.0MW, increases of +12.5% y/y and decreases of 5.7% sequentially

- Net revenue was RMB 2.4 billion ($390.5 million), an increase of +52.9% y/y and +6.5% sequentially

- Gross margin was 15.2%, an increase of 710 basis points y/y but a decrease of 150 basis points sequentially

- Operating profit was RMB 89.7 million ($14.5 million), compared to an operating loss of RMB 33.3 million ($5.4 million) in the second quarter of 2013, and an operating profit of RMB 160.9 million ($25.9 million) in the first quarter of 2014

- Net income was RMB 40.1 million ($6.5 million), compared to a net loss of RMB 132.4 million ($21.3 million) in the second quarter of 2013, and a net income of RMB 85.0 million ($13.7 million) in the first quarter of 2014

- Earnings per diluted ADS were RMB 0.59 ($0.10), compared to a loss per diluted ADS of RMB 3.58 ($0.58) in the second quarter of 2013, and an earnings per diluted ADS of RMB 1.41 ($0.23) in the first quarter of 2014

- Cash and cash equivalents were RMB 2.0 billion ($326.9 million), an increase of RMB 80.1 million ($12.9 million) during the quarter

- Operating cash flow was negative RMB 84.0 million ($13.5 million), compared to positive RMB 198.2 million ($32.0 million) in the first quarter of 2014

- Non-GAAP earnings1 per diluted ADS were RMB 0.87 ($0.14), compared to Non-GAAP loss per diluted ADS of RMB 3.58 ($0.58) in the second quarter of 2013, and Non-GAAP earnings per diluted ADS of RMB 1.99 ($0.32) in the first quarter of 2014

Mr. Baofang Jin, chairman and CEO of JA Solar, commented, "Our second quarter results were satisfactory, with strong revenue growth, continued bottom-line profitability, and progress in our transition from cells to modules as our main revenue stream. This successful transition has enabled us to emerge as a tier 1 module supplier in the world. Furthermore, we are actively growing our downstream business. In the second half of 2014, we expect to sustain both our growth and profitability, due to accelerating activity in China, and continued favorable product and geographic mix"

Mr. Jin continued, "Notably, our geographic mix in modules remains very favorable, a result of our determination to focus on the countries with the best growth and pricing prospects. Japan performed very well in the quarter, while module shipments into China and Europe were stable. North America saw a solid surge sequentially and now represents 9% of our module sales. This favorable geographic exposure is the result of strategic decisions we made in the past several quarters."

"We are confident in our prospects in the second half of this year. Our optimistic outlook is predicated on several trends. We expect better demand in China as both utility scale and distributed generation projects start construction in the second half. We believe secular demand trends in Japan will continue due to their unique energy needs, and we expect to grow our business in the North American market. Therefore we have revised up our full year shipment objective to be in the range of 2.9GW to 3.1GW."

Second Quarter 2014 Financial Results

All shipment and financial figures refer to the quarter ended June 30, 2014, unless otherwise specified. All "year over year" or "y/y" comparisons are against the quarter ended June 30, 2013. All "sequential" comparisons are against the quarter ended March 31, 2014.

Total shipments were 681.8MW, within the range of previous announced guidance of 670 to 700MW. Shipments grew 6.8% sequentially and 47.0% year-over-year. In addition, the Company shipped 43.7MW of modules to its downstream projects.

Net revenue was RMB 2.4 billion ($390.5 million), an increase of 52.9% y/y and 6.5% sequentially. Growth was driven by the ongoing shift in sales to modules, which were 65.4% of shipments, as well as penetration of our key geographies, most notably China and Japan.

Gross profit of RMB 367.9 million ($59.3 million) increased 185.9% y/y but declined 3.3% sequentially. Gross margin was 15.2%, which compares to 8.1% in the year-ago quarter, and 16.7% in the first quarter of 2014. The gross margin increase y/y was due to improved overall market conditions. The sequential decline was primarily due to a higher percentage of module shipments to China, where the module ASP declined slightly, and an adjustment of the minimum import price in European Union.

Total operating expenses of RMB 278.2 million ($44.8 million) were 11.5% of revenue. This compares to operating expenses of 10.2% of revenue in the year-ago quarter, and 9.7% of revenue in the first quarter of 2014. The sequential increase in operating expense was primarily due to increased freight and insurance expenses associated with increased module shipments, especially to the Americas.

Operating profit was RMB 89.7 million ($14.5 million), compared to an operating loss of RMB 33.3 million ($5.4 million) in the year-ago quarter, and operating profit of RMB 160.9 million ($25.9 million) in the first quarter. The sequential decrease in operating profit was primarily due to the increased operating expenses.

Interest expense was RMB 54.8 million ($8.8 million), compared to RMB 79.7 million ($12.9 million) in the year-ago quarter, and RMB 56.8 million ($9.2 million) in the first quarter of 2014.

The change in fair value of warrant derivatives was negative RMB 16.4 million ($2.6 million), compared with negative RMB 33.6 million ($5.4 million) in the first quarter of 2014. The warrants were issued on August 16, 2013 in conjunction with the Company's $96 million registered direct offering, so there is no year-over-year comparison. The change-in-fair-value expense, which was a non-cash charge, was mainly due to the increase in the Company's stock price during the quarter.

Earnings per diluted ADS were RMB 0.59 ($0.10), compared to a loss per diluted ADS of RMB 3.58 ($0.58) in the year-ago quarter, and earnings per diluted ADS of RMB 1.41 ($0.23) in the first quarter of 2014.

Operating cash flow was negative RMB 84.0 million ($13.5 million).

Liquidity

As of June 30, 2014, the Company had cash and cash equivalents of RMB 2.0 billion ($326.9 million), and total working capital of RMB 1.7 billion ($275.7 million). Total short-term borrowings were RMB 1.9 billion ($309.2 million). Total long-term borrowings were RMB 1.9 billion ($305.5 million), of which RMB 272.0 million ($43.8 million) were due in one year.

Business Outlook

For the third quarter of 2014, the Company expects total cell and module shipments to be in the range of 730MW to 760MW. For the full year 2014, the Company revised up its previous shipment guidance. The Company now expects to ship between 2.9GW and 3.1GW, higher than previous guidance of a range of 2.7GW to 2.9GW. Consistent with the previous guidance, the new guidance includes 200MW of module shipments to the Company's downstream projects.

Manufacturing Capacity Update

With the completion of its capacity expansion during the quarter, JA Solar now has annual wafer production capacity of 1.0GW, annual cell production capacity of 2.8GW, and annual module production capacity of 2.8GW. Since the end of 2013, cell capacity has increased by 300MW, while module capacity has increased by 1GW.